- Standard Chartered Bank projects Ethereum will hit the $8,000 price mark driven by the awaited Ethereum ETF approval by the SEC this week.

- The long-awaited Ethereum ETF approval will bolster both the ETH price as well as the general cryptocurrency market.

Standard Chartered Bank, a British multinational bank has affirmed Ethereum’s optimistic forecast with a bullish prediction of $8,000 mark by the end of the year. This positive expectation has been stimulated by the growing anticipation of the spot Ethereum ETF approval by the U.S. Securities and Exchange Commission (SEC).

Communicating with a leading news outlet, Geoffrey Kendrick, the head of crypto research at Standard Chartered expressed his conviction on the anticipated approval of spot Ethereum ETFs.

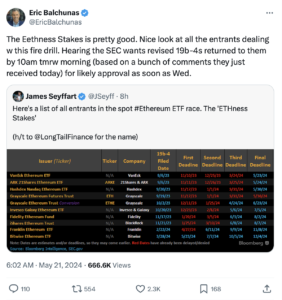

Geoffrey’s affirmations followed Bloomberg’s Eric Balchunas analysis which improved the likelihood of Spot Ethereum ETF being approved by approval from 25% to 75%. The uptick was influenced by a shift in the Biden administration’s stance on these financial products. Correspondingly, Polymarket took the bid higher from 10% to 60%.

This expectancy has had a ripple effect across the cryptocurrency market affecting this digital asset price. As Crypto News Flash reported, Ethereum saw an 18% rally to a peak almost hitting the $3,700 mark citing the growing investor confidence.

This surge was accompanied by a significant drop in the net asset value (NAV) discount on the Grayscale Ethereum Trust (ETHE), which jumped from -25% to -12% within a day.

According to Geoffrey, the approval could bring a huge tone of market inflows, estimating an inpour of about $15 billion and $45 billion in the first year alone. He stated that Ethereum ETFs will have a significant impact more than Bitcoin ETFs due to a lack of options for holding Ethereum. This inflow is supposed to lead the ETH price to the predicted $8,000.

The likely approval of Ethereum ETFs will mark as a stepping stone for the whole cryptocurrency landscape marking a significant step towards global cryptocurrency adoption and acceptance not only by investors but by lawmakers.

Balchunas also noted that the approval of Bitcoin ETFs came moments after the hacked SEC X account announced approval. Crypto enthusiasts are on the lookout for such an occasion Ethereum ETF decision.

In an elaborate March research note, Kendrick pointed out that the introduction of Ethereum ETFs would see possession of 2.39 to 9.15 million ether within the first 12 months after the approval. Kendrick also noted that Ethereum had the capability of maintaining its price ratio against Bitcoin.

The potential approval of the first Spot Ethereum ETF in the US has led to Ethereum’s market cap surpassing the $450 billion mark. This has seen Ethereum replacing Mastercard holding the 26th on the global asset ranking.

Bloomberg analysts braced up Investor confidence by increasing the stakes of the approval of ETH ETFs up to 75%. This adjustment followed reports of the SEC quickly changing its stance on ETF approvals, suggesting exchanges update their filings. Eric Balchunas further noted that there were high expectations that the Ethereum EF approval could come in as late as Thursday.

This might accelerate Ethereum’s price even higher this week. On the contrary, there are speculations leading towards the approval of Ethereum ETFs being denied due to certain reasons. Legal analysts like Scott Johnson and Alex Thorn believe that the SEC might disapprove of the Ethereum ETFs because it might consider Ethereum as an unregistered security. According to Alex, the SEC might flag Ethereum as a non-security but staked Ether passed as a security.

In conclusion, the approval of Ethereum ETFs would be a game changer in the cryptocurrency arena. Positive speculations from Standard Chartered signify a growing potential driven by institutional investors.